38 is yield to maturity the same as coupon rate

Difference Between Coupon Rate And Yield Of Maturity What is the major difference between a coupon rate and yield of maturity? The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded. Is the yield to maturity on a bond the same thing as ... Finance questions and answers. Is the yield to maturity on a bond the same thing as the required return? Is YTM the same thing as the coupon rate? Suppose today a 10 percent coupon bond sells at par. Two years from now, the required return on the same bond is 8 percent. What is the coupon rate on the bond then?

Yield to Maturity (YTM) Definition 6.9.2021 · Calculations of yield to maturity (YTM) assume that all coupon payments are reinvested at the same rate as the bond's current yield and take into account the bond's current market price, par value ...

Is yield to maturity the same as coupon rate

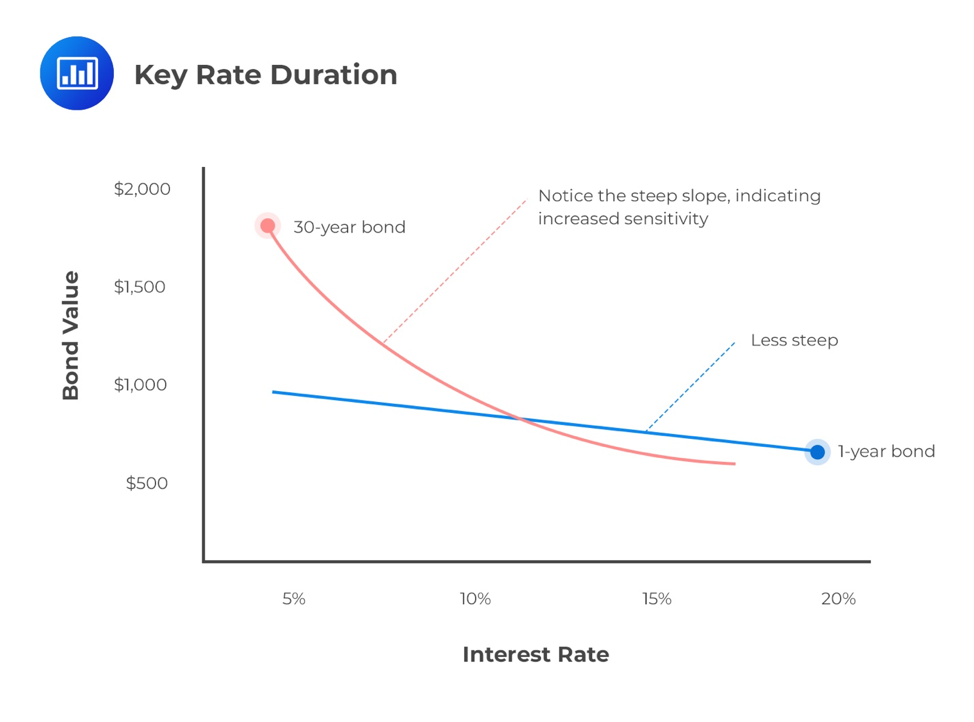

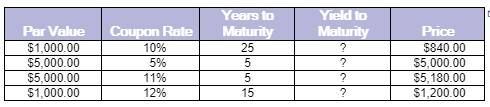

When is a bond's coupon rate and yield to maturity the same? A bond's coupon rate is equal to its yield to maturity if its purchase price is equal to its par value. The par value of a bond is its face value, ... Bond Yield to Maturity (YTM) Calculator - DQYDJ Yield to Maturity (%): The converged upon solution for the yield to maturity of the bond (the internal rate of return) Yield to Maturity ... these calculations assume no missed or delayed payments and reinvesting at the same rate upon coupon payments. For other calculators in our financial basics series, please see: Zero Coupon Bond Calculator; Financial Management Chapter 7 Flashcards - Quizlet a. If two bonds have the same maturity, the same yield to maturity, and the same level of risk, the bonds should sell for the same price regardless of their coupon rates. b. All else equal, an increase in interest rates will have a greater effect on higher-coupon bonds than it will have on lower-coupon bonds. c.

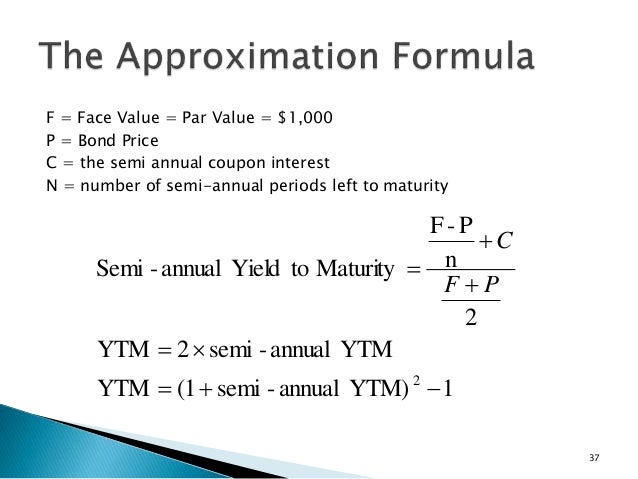

Is yield to maturity the same as coupon rate. Coupon Rate vs Yield to Maturity - StockMarketBox The main difference between yield to maturity and coupon rate is that the coupon rates remain the same throughout the term of the bond. The yield to maturity changes depending on many factors, such as the remaining years until maturity and the current bond price. Another example illustrates the distinction between yield to maturity and coupon rate. Coupon Rate Definition - Investopedia At the time it is purchased, a bond's yield to maturity and its coupon rate are the same. The yield to maturity (YTM) is the percentage rate of return for a ... How to calculate yield to maturity in Excel (Free Excel ... 12.9.2021 · Coupon Rate, rate = 6%; Coupons per Year, nper = 4 (quarterly) Years of Maturity = 10; Now, you went to a bond rating agency (Moody’s, S&P, Fitch, etc.) and they rated your bond as AA+. More about the bond rating. But the problem is: when you tried to sell the bond, you see that the same rated bond is selling with 7.5% YTM (yield to maturity). What Is the Difference Between IRR and the Yield to Maturity? 27.3.2019 · Where C is the coupon interest payment, F is the face value of the bond, P is the market price of the bond, and "n" is the number of years to maturity. For example, let's say that we buy a bond ...

Current Yield vs. Yield to Maturity - Investopedia When a bond's market price is above par, which is known as a premium bond, its current yield and YTM are lower than its coupon rate. Conversely, when a bond ... Bond Yield Rate vs. Coupon Rate: What's the Difference? In order for the coupon rate, current yield, and yield to maturity to be the same, the bond's price upon purchase must be equal to its par value. Difference Between Yield to Maturity and Coupon Rate ... The key difference between yield to maturity and coupon rate is that yield to maturity is the rate of return estimated on a bond if it is held until the maturity date, whereas coupon rate is the amount of annual interest earned by the bondholder, which is expressed as a percentage of the nominal value of the bond. CONTENTS. 1. Yield to Maturity vs Coupon Rate - Speck & Company Yield to Maturity (YTM) is the expected rate of return on a bond or fixed-rate security that is bought by an investor and held to maturity. Coupon rate is a fixed value in relation to the face value of a bond. If yield to maturity is greater than the coupon rate, the bond is trading at a discount to its par value.

Solved Is the yield to maturity on a bond the same thing ... This problem has been solved! Is the yield to maturity on a bond the same thing as the required return? Is YTM the same thing as the coupon rate? Suppose today a 10 percent coupon bond sells at par. Two years from now, the required return on the same bond is 8 percent. Yield to Maturity vs. Coupon Rate: What's the Difference? Aug 22, 2021 · If an investor purchases a bond at par or face value, the yield to maturity is equal to its coupon rate. If the investor purchases the bond at a discount, its yield to maturity will be higher than... Yield to Maturity (YTM) - Overview, Formula, and Importance On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity Coupon Rate - Meaning, Calculation and Importance The coupon rate payments are the same for the bond tenure. While the yield on maturity varies depending on various factors such as the number of years till maturity and the current trading price of the bond. Let's assume the couponrate for a bond is 15%. Following is the relationship between the bond prices with the couponrate and YTM.

The Difference Between Coupon and Yield to Maturity - The ... Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate.

Yield to Maturity (YTM): Formula and Excel Calculator The coupon payments were reinvested at the same rate as the yield-to-maturity (YTM). Said differently, the yield to maturity (YTM) on a bond is its internal rate of return (IRR) - i.e. the discount rate which makes the present value (PV) of all the bond's future cash flows equal to its current market price.

Understanding Coupon Rate and Yield to Maturity of Bonds ... The resulting YTM will differ from the coupon rate. This is simply because interest rates change daily. To prove this point, say a month later you decide to purchase the same RTB 03-11 in the secondary market. However, Interest rates increased. From 2.375%, quoted yield increased to 2.700%.

Is the yield to maturity on a bond the same thing as the ... The yield to maturity is simply the required rate of return on a bond. They are typically used interchangeably. Furthermore, the YTM is not the same thing as the coupon rate. YTM is the percentage rate of return while the coupon rate is the annual amount of interest that the bond owner will receive.

Is the Yield to Maturity on a Bond the Same Thing As the ... If you paid $1,000 for the bond, your yield is 5 percent — the same as the coupon rate. If you paid $990.57 for the bond, your yield is 6 percent — you get the same $1,050 back, but it now represents a 6 percent return on your initial investment. If you paid $1,009.62 for the bond, your yield falls to 4 percent.

Yield to Maturity - YTM vs. Spot Rate. What's the Difference? A bond's yield to maturity is based on the interest rate the investor would earn from reinvesting every coupon payment. The coupons would be reinvested at an average interest rate until the bond...

Chapter 10 Flashcards - Quizlet Yield to maturity > Coupon rate > Current yield a Consider a five-year bond with a 10 percent coupon that is presently trading at a yield to maturity of 8 percent. If market interest rates do not change, one year from now the price of this bond a. Will be higher b. Will be lower c. Will be the same d. Cannot be determined b

Yield to Maturity (YTM) Definition & Example ... The yield to maturity is the percentage of the rate of return for a fixed-rate security should an investor hold onto the asset until maturity. The coupon rate is simply the amount of interest an investor will receive. Also known as nominal yield or the yield from the bond, the coupon rate doesn't change. Simply put, it is the total value of ...

Yield - What is Yield? For A Stock, Bond, ETF, or Mutual ... -Maturity represents the day the bond will be paid back. So an investor who purchased $10,000 of these bonds at their issue will receive 4.375% (the coupon rate) a year until the year 2023. Now look in the lower left at “Price” and “Current Yield”. Remember that the bond’s par value was 100, now the price of the bond has increased to ...

1. The following table summarizes prices of various default-free, zero-coupon bonds (expressed ...

fin 300 Flashcards - Quizlet Bond J has a coupon rate of 4 percent. Bond S has a coupon rate of 14 percent. Both bonds have 10 years to maturity, make semiannual payments, and have a YTM of 8 percent.

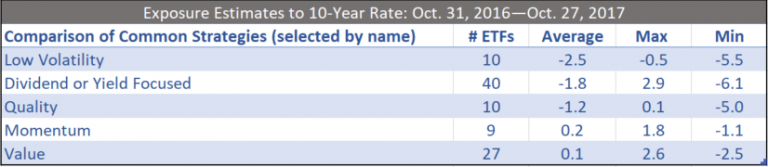

Smart Beta Rate Sensitivity: How Fed Rate Decisions Could Impact One of the Fastest Growing Fund ...

How to Calculate Yield to Maturity: 9 Steps (with Pictures) 6.5.2021 · Yield to Maturity (YTM) ... the price. Chances are, you will not arrive at the same value. This is because this yield to maturity calculation is an estimate. Decide whether you are satisfied with the estimate or if you need more precise information. ... Since we know that the coupon rate is 5 percent, ...

Ch3- Practice Questions Flashcards - Quizlet A) When the coupon bond is priced at its face value, the yield to maturity equals the coupon rate. B) The price of a coupon bond and the yield to maturity are negatively related. C) The yield to maturity is greater than the coupon rate when the bond price is below the par value. D) All of the above are true. E) Only A and B of the above are true.

chapter 4 Flashcards - Quizlet 14) Which of the following are true for a coupon bond? A) When the coupon bond is priced at its face value, the yield to maturity equals the coupon rate. B) The price of a coupon bond and the yield to maturity are positively related. C) The yield to maturity is greater than the coupon rate when the bond price is above the par value.

Difference Between Coupon Rate and Yield to Maturity (With ... The main difference between Coupon Rate and Yield to Maturity (YTM) is that Coupon Rate is the fixed sum of money that a person has to pay at face value. In contrast, Yield to Maturity (YTM) is the amount a person will retrieve after the maturation of their bonds. The Coupon Rate is said to be the same throughout the bond tenure year.

What is the difference between discount rate and yield? Yield to maturity is the discount rate at which the sum of all future cash flows from the bond (coupons and principal) is equal to the current price of the bond. The YTM is often given in terms of Annual Percentage Rate (A.P.R.), but more often market convention is followed.

Financial Management Chapter 7 Flashcards - Quizlet a. If two bonds have the same maturity, the same yield to maturity, and the same level of risk, the bonds should sell for the same price regardless of their coupon rates. b. All else equal, an increase in interest rates will have a greater effect on higher-coupon bonds than it will have on lower-coupon bonds. c.

/GettyImages-527870974-576029945f9b58f22eb93d7d.jpg)

Post a Comment for "38 is yield to maturity the same as coupon rate"