42 consider a bond paying a coupon rate of 10 per year semiannually when the market

Solved Consider a bond paying a coupon rate of 10% per - Chegg Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has 3 years until maturity. a. Find the bond's price today and 6 months from now after the next coupon is paid. b. What is the total (6 month) rate of return on the bond? Expert Answer Success Essays - Assisting students with assignments online $10.91 The best writer. $3.99 Outline. $21.99 Unlimited Revisions. Get all these features for $65.77 FREE. Do My Paper. Essay Help for Your Convenience. ... We offer the lowest prices per page in the industry, with an average of $7 per page. Success Essays Features. Get All The Features For Free. $11. per page. FREE Plagiarism report.

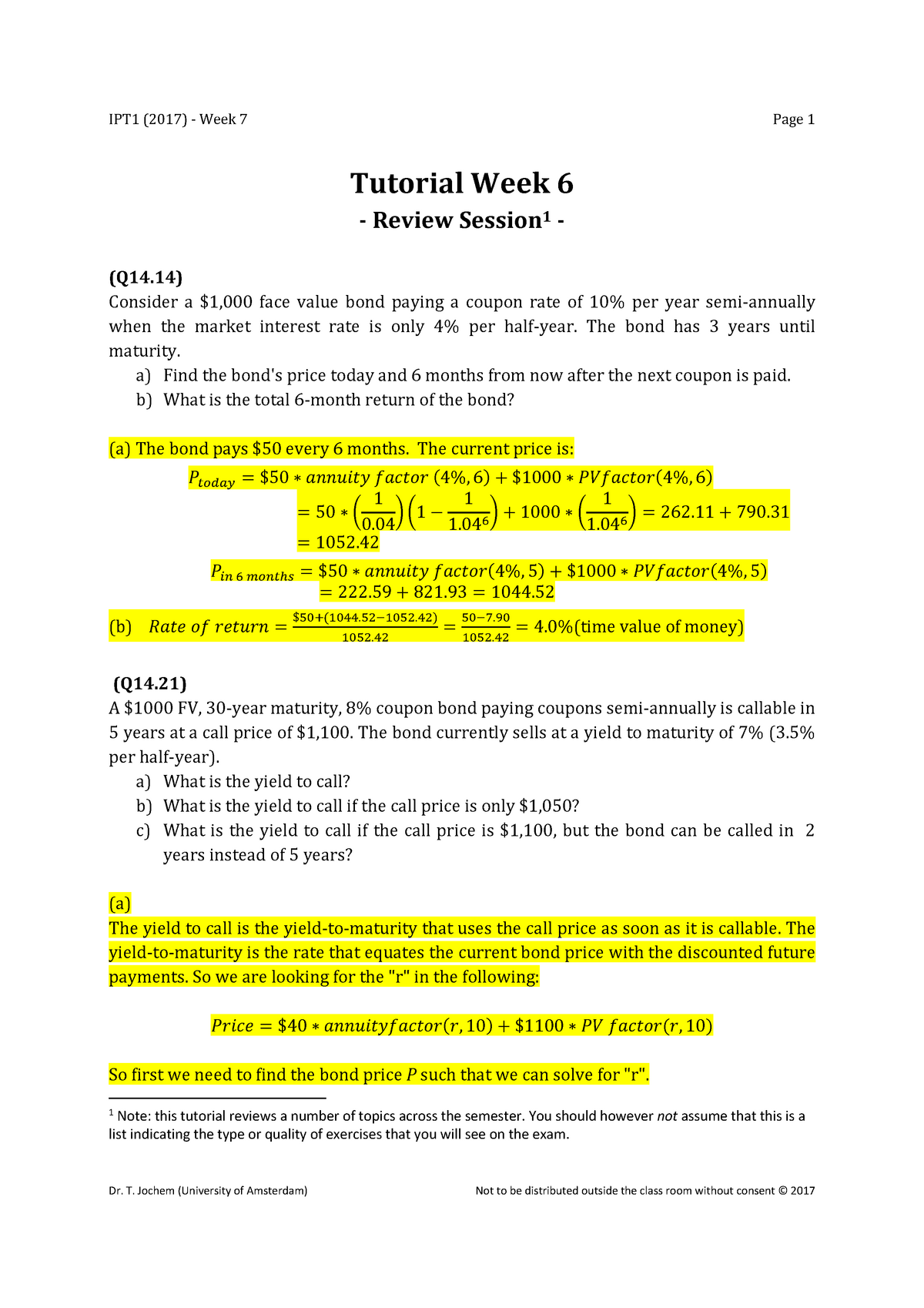

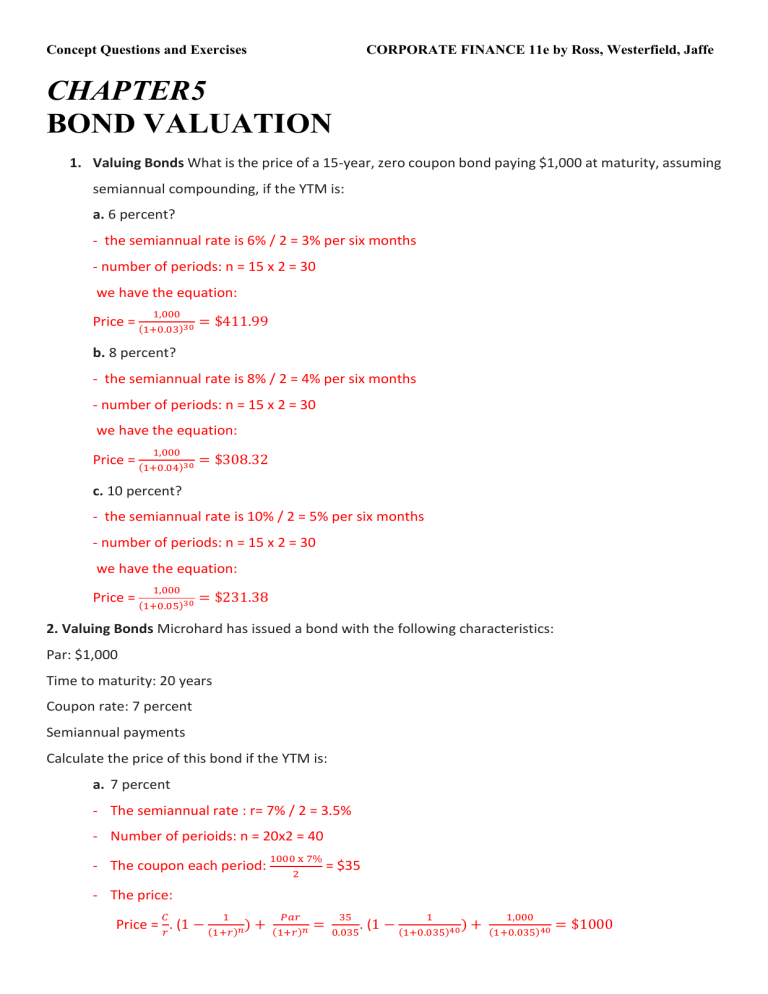

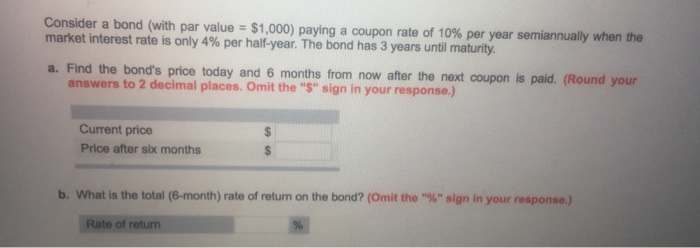

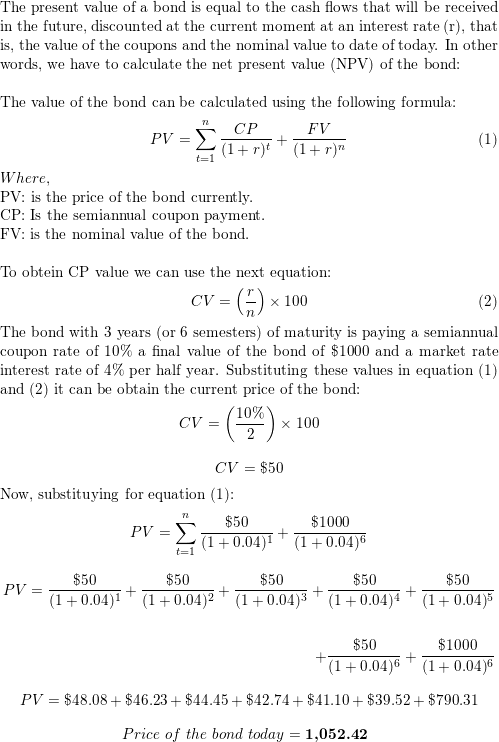

Consider a bond paying a coupon rate of 10% per year semiannually ... Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half year. The bond has three years until maturity. Find the bond's price today and 6 months from now after the next coupon is paid. What is the 6-month holding-period return on this bond?

Consider a bond paying a coupon rate of 10 per year semiannually when the market

Consider a bond paying a coupon rate of 10% per year Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has 3 years until maturity. a. Find the bond's price today and 6 months from now after the next coupon is paid. b. What is t coursehelponline.comCourse Help Online - Have your academic paper written by a ... With course help online, you pay for academic writing help and we give you a legal service. This service is similar to paying a tutor to help improve your skills. Our online services is trustworthy and it cares about your learning and your degree. Hence, you should be sure of the fact that our online essay help cannot harm your academic life. successessays.comSuccess Essays - Assisting students with assignments online $10.91 The best writer. $3.99 Outline. $21.99 Unlimited Revisions. ... We offer the lowest prices per page in the industry, with an average of $7 per page.

Consider a bond paying a coupon rate of 10 per year semiannually when the market. Answered: Consider a bond paying a coupon rate of… | bartleby Question. Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. b. Consider a bond paying a coupon rate of 10% per year semiann - Quizlet Expert solutions Question Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. Find the bond's price today and six months from now after the next coupon is paid. Solutions Verified Solution A Solution B Create an account to view solutions Taxation Rules for Bond Investors Jan 31, 2021 · Therefore, investors who own 100 corporate bonds at $1,000 par value, with each paying 7% annually, can expect to receive $7,000 of taxable interest each year. Capital Gains Solved Consider a bond paying a coupon rate of 10% per year - Chegg Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. (LO 10 a. Find the bond's price today and six months from now after the next coupon is paid b. What is the total rate of return on the bond?

1. Consider a bond paying a coupon rate of 10% per year...get 5 - Quesba 1. Consider a bond paying a coupon rate of 10% per year...get 5 Accounting Financial Accounting Cost Management Managerial Accounting Advanced Accounting Auditing Accounting - Others Accounting Concepts and Principles Taxation Accounting Information System Accounting Equation Financial Analysis Managerial Accounting - Decision Making Practice problems - Consider a bond paying a coupon rate of 10% per ... Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Publication 550 (2021), Investment Income and Expenses You bought a 10-year bond with a stated redemption price at maturity of $1,000, issued at $980 with OID of $20. One-fourth of 1% of $1,000 (stated redemption price) times 10 (the number of full years from the date of original issue to maturity) equals $25. Because the $20 discount is less than $25, the OID is treated as zero. Answered: Tom creates a 30-year mortgage of… | bartleby Q: (i) A $10,000 bond is purchased for $9600 and has a bond rate of 6% per year payable semiannually… A: Part-1) Face Value of Bond is $10,000 Present Value of bond is $9600 Coupon rate is 6% payable…

Interest - Wikipedia Compound interest includes interest earned on the interest that was previously accumulated. Compare, for example, a bond paying 6 percent semiannually (that is, coupons of 3 percent twice a year) with a certificate of deposit that pays 6 percent interest once a year.The total interest payment is $6 per $100 par value in both cases, but the holder of the semiannual … Consider a bond paying a coupon rate of 10% per year semiannually when ... Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4%. The bond has 3 years until maturity. a. Find the bond price today and six months from now after the next coupon is paid, assuming the market rate will be constant during the following 6 months. b. en.wikipedia.org › wiki › InterestInterest - Wikipedia Compare, for example, a bond paying 6 percent semiannually (that is, coupons of 3 percent twice a year) with a certificate of deposit that pays 6 percent interest once a year. The total interest payment is $6 per $100 par value in both cases, but the holder of the semiannual bond receives half the $6 per year after only 6 months (time ... Consider a bond paying a coupon rate of 10% per year Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. b. What is the total rate of return on the bond?

Bus1-170 Exam 2 Flashcards | Quizlet Last year, the market interest rate was 10.0%, but it has increased to 12.0%. The amount of capital exchanged increased from $8.0 billion to $10.0 billion. ... If the coupon interest rate is 4.375% for the first six months and changes to a rate equal to the 10-year Treasury bond rate plus 1.3% thereafter, the bond is called a floating-rate bond ...

› publications › p550Publication 550 (2021), Investment Income and Expenses ... You bought a 10-year bond with a stated redemption price at maturity of $1,000, issued at $980 with OID of $20. One-fourth of 1% of $1,000 (stated redemption price) times 10 (the number of full years from the date of original issue to maturity) equals $25. Because the $20 discount is less than $25, the OID is treated as zero.

Assignment Essays - Best Custom Writing Services $10.91 The best writer. $3.99 Outline. $21.99 Unlimited Revisions. Get all these features for $65.77 FREE. Do My Paper. Essay Help for Your Convenience. ... We offer the lowest prices per page in the industry, with an average of $7 per page. Assignment Essays Features. Get All The Features For Free. $11. per page. FREE Plagiarism report.

[Solved]: Consider a bond paying a coupon rate of 10.25% pe Consider a bond paying a coupon rate of 10.25% per year semiannually when the market interest rate is only 4.1% per half-year. The bond has four years until maturity. Required: a. Find the bond's price today and six months from now after the next coupon is paid. (Do not round intermediate calculations. Round your answers to 2 decimal places.)

I Bond Returns: Almost Too Good To Be True - Financial Samurai Dec 15, 2021 · The true risk-free rate is the 10-year bond yield since there is no cap on how much one can purchase. However, the I Bond yield is also a worthwhile risk-free rate. ... We also know the average return for the aggregate bond market is around 5%. Therefore, if you construct a simple 60/40 portfolio, the expected return based on historical figures ...

Course Help Online - Have your academic paper written by a … With course help online, you pay for academic writing help and we give you a legal service. This service is similar to paying a tutor to help improve your skills. Our online services is trustworthy and it cares about your learning and your degree. Hence, you should be sure of the fact that our online essay help cannot harm your academic life.

assignmentessays.comAssignment Essays - Best Custom Writing Services $10.91 The best writer. $3.99 Outline. $21.99 Unlimited Revisions. Get all these features for $65.77 FREE. ... We offer the lowest prices per page in the industry ...

Consider a bond (with par value = $1,000) paying a coupon rate of 10% ... Consider a bond (with par value = $1,000) paying a coupon rate of 10% per year semiannually when the market interest rate is only 7% per half-year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. (Round your answers to 2 decimal places.)

› i-bond-returnsI Bond Returns: Almost Too Good To Be True - Financial Samurai Dec 15, 2021 · If someone bought I-Bond on Nov 10, 2019, their fixed rate is 0.2% and inflation rate will vary every 6 months there after, the calculation would follow this way, Nov 10 2019 to May 10, 2020: (0.2+1.01×2 Inflation Rate)=2.22%

Investments Final Flashcards | Quizlet Consider a bond paying a coupon rate of 10% per year semi-annually when the market rate of interest is 8.5% per year. The bond has three years until maturity. Calculate the bond's price today. 1,000 FV, 50 PMT, 6 N, 4.25 I/Y CPT PV = 1,038.99805 Price = $1,039.00 YTM- Zero Coupon Bond

Consider a bond paying a coupon rate of 10% per year...get 5 Answer of Consider a bond paying a coupon rate of 10% per year semiannually when the market-interest rate is only 4% per half a year. The bond has 3 years until...

1. Consider a bond paying a coupon rate of 10% per year semiannually ... 1. Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. b. What is the total rate of return on the bond?

Guide to Fixed Income: Types and How to Invest - Investopedia Aug 31, 2022 · Fixed income is a type of investment in which real return rates or periodic income is received at regular intervals and at reasonably predictable levels. Fixed-income investments can be used to ...

quizlet.com › 538573382 › bus1-170-exam-2-flash-cardsBus1-170 Exam 2 Flashcards | Quizlet If the coupon interest rate is 4.375% for the first six months and changes to a rate equal to the 10-year Treasury bond rate plus 1.3% thereafter, the bond is called a floating-rate bond. floating-rate

successessays.comSuccess Essays - Assisting students with assignments online $10.91 The best writer. $3.99 Outline. $21.99 Unlimited Revisions. ... We offer the lowest prices per page in the industry, with an average of $7 per page.

coursehelponline.comCourse Help Online - Have your academic paper written by a ... With course help online, you pay for academic writing help and we give you a legal service. This service is similar to paying a tutor to help improve your skills. Our online services is trustworthy and it cares about your learning and your degree. Hence, you should be sure of the fact that our online essay help cannot harm your academic life.

Consider a bond paying a coupon rate of 10% per year Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has 3 years until maturity. a. Find the bond's price today and 6 months from now after the next coupon is paid. b. What is t

:max_bytes(150000):strip_icc()/what-are-bonds-and-how-do-they-work-3306235_V3-cc55a8d3b82d4d34a991d6cc4fa8a865.png)

Post a Comment for "42 consider a bond paying a coupon rate of 10 per year semiannually when the market"