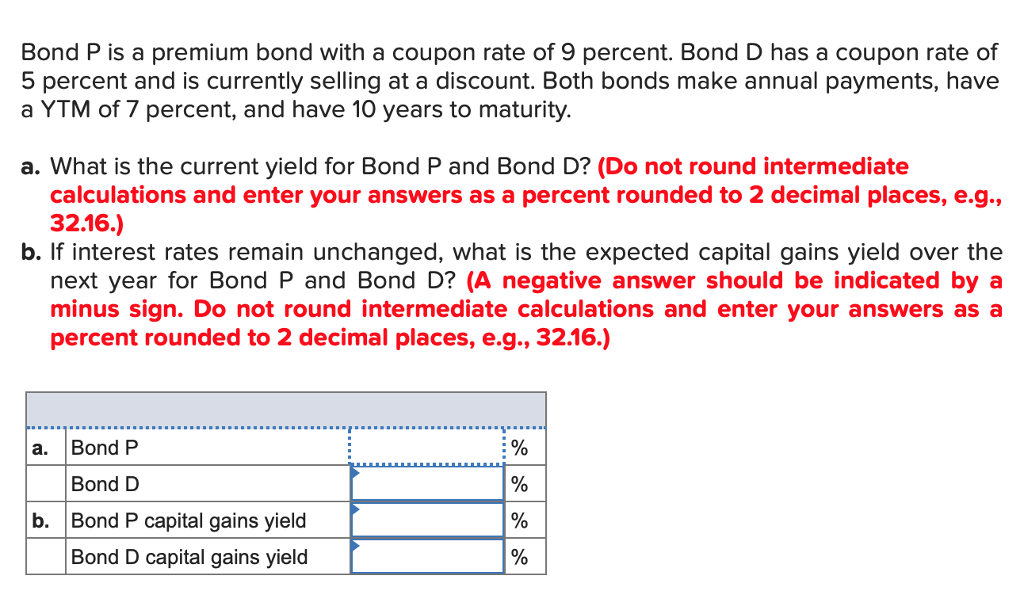

43 coupon rate and ytm

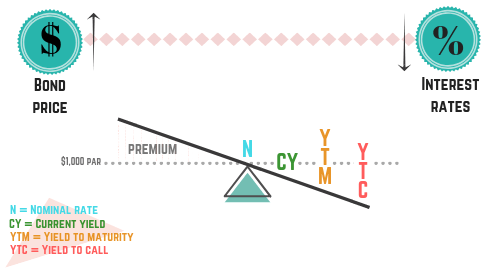

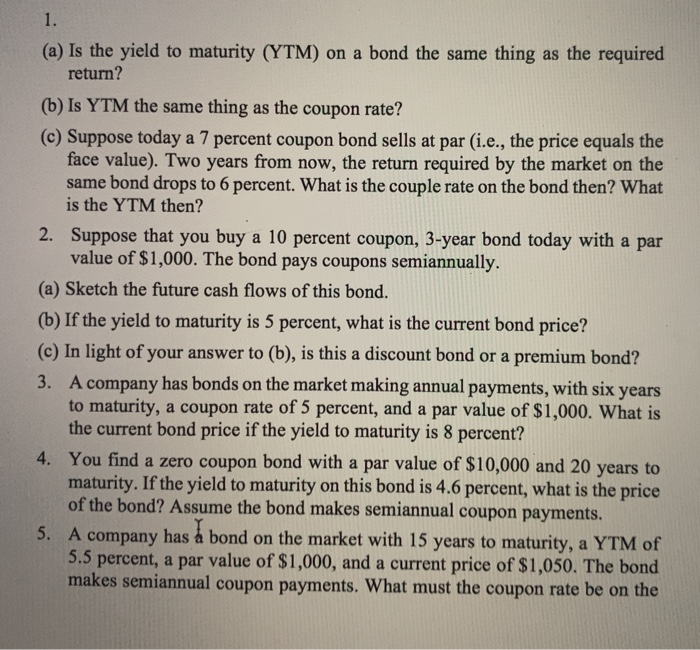

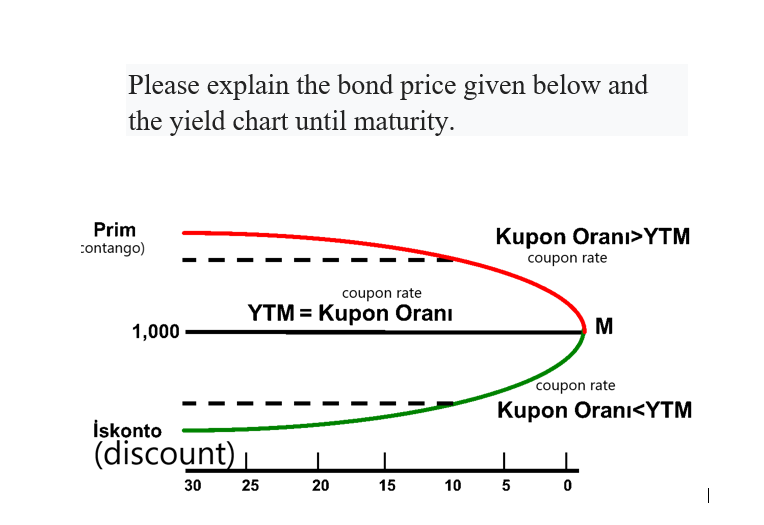

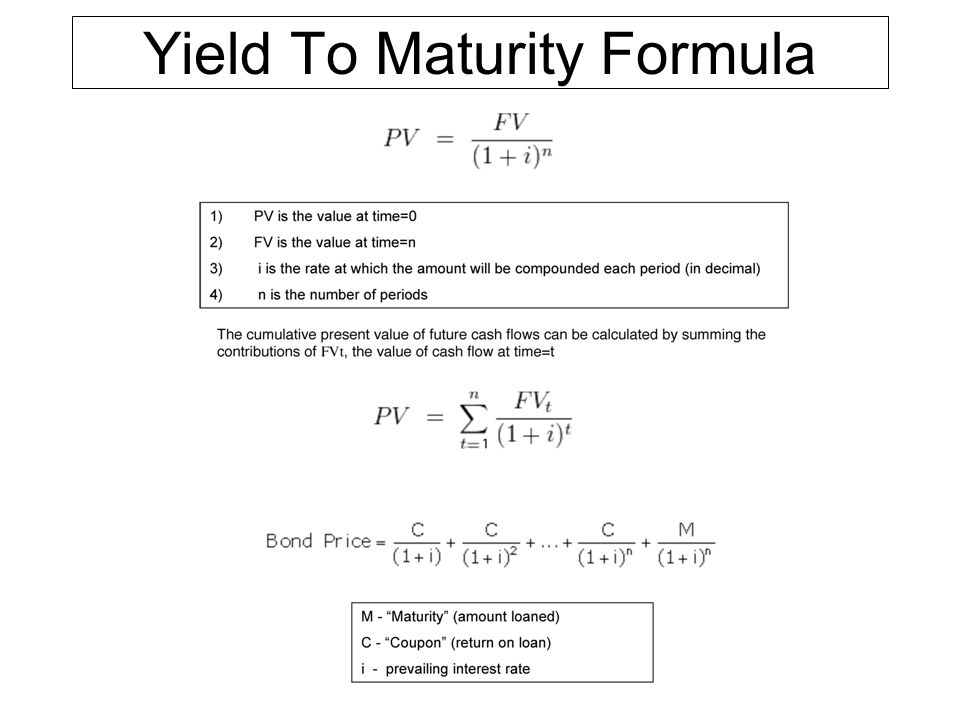

Yield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... Yield to maturity - Wikipedia The yield to maturity (YTM), book yield or redemption yield of a bond or other fixed-interest security, such as gilts, is an estimate of the total rate of return anticipated to be earned by an investor who buys a bond at a given market price, holds it to maturity, and receives all interest payments and the capital redemption on schedule.

Yield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ...

Coupon rate and ytm

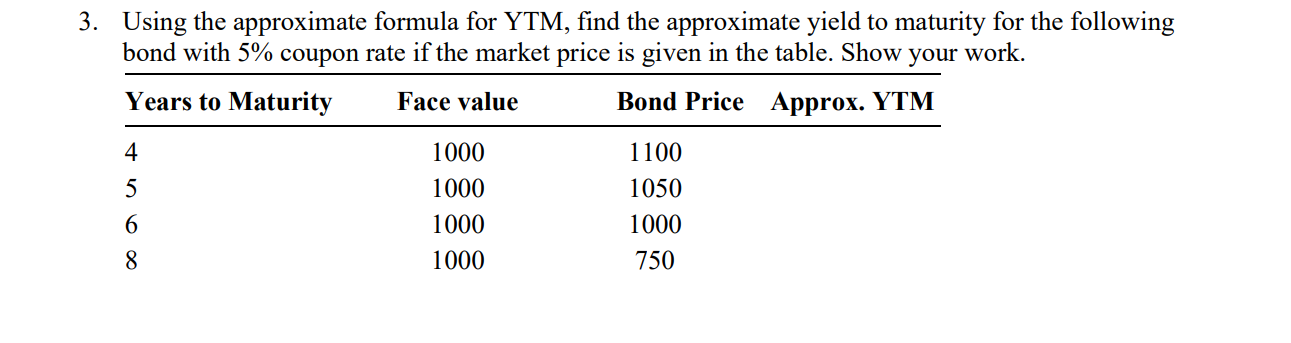

Yield to Maturity vs. Yield to Call: The Difference Sep 16, 2022 · Yield to maturity is based on the coupon rate, face value, purchase price, and years until maturity, calculated as: Yield to maturity = {Coupon rate + (Face value – Purchase price/years until ... Coupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... Yield to Maturity Calculator | Calculate YTM Oct 15, 2022 · coupon rate - Annual coupon rate; frequency - Number of times the coupon is distributed in a year; and; n - Years to maturity. Let's take Bond A issued by Company Alpha, which has the following data, as an example of how to find YTM: Bond price: $980; Face value: $1,000; Annual coupon rate: 5%; Coupon Frequency: Annual; Years to maturity: 10 years

Coupon rate and ytm. Bond Yield to Maturity (YTM) Calculator - DQYDJ You can compare YTM between various debt issues to see which ones would perform best. Note the caveat that YTM though – these calculations assume no missed or delayed payments and reinvesting at the same rate upon coupon payments. For other calculators in our financial basics series, please see: Zero Coupon Bond Calculator Yield to Maturity Calculator | Calculate YTM Oct 15, 2022 · coupon rate - Annual coupon rate; frequency - Number of times the coupon is distributed in a year; and; n - Years to maturity. Let's take Bond A issued by Company Alpha, which has the following data, as an example of how to find YTM: Bond price: $980; Face value: $1,000; Annual coupon rate: 5%; Coupon Frequency: Annual; Years to maturity: 10 years Coupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... Yield to Maturity vs. Yield to Call: The Difference Sep 16, 2022 · Yield to maturity is based on the coupon rate, face value, purchase price, and years until maturity, calculated as: Yield to maturity = {Coupon rate + (Face value – Purchase price/years until ...

Post a Comment for "43 coupon rate and ytm"