44 yield to maturity coupon bond

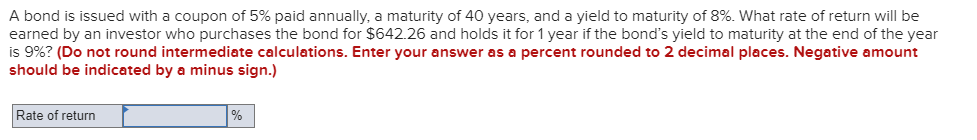

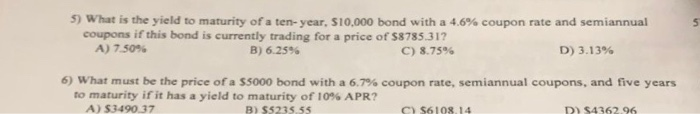

› Yield_to_MaturityYield to Maturity - Approximate Formula (with Calculator) Through trial and error, the yield to maturity would be 11.38%, which is found by adjusting each estimated rate until the present value equals the price of the bond. Excel is helpful for the trial and error method by setting the spreadsheet so that all that is required to determine the present value is adjusting a fixed cell that contains the rate. en.wikipedia.org › wiki › Yield_to_maturityYield to maturity - Wikipedia Then continuing by trial and error, a bond gain of 5.53 divided by a bond price of 99.47 produces a yield to maturity of 5.56%. Also, the bond gain and the bond price add up to 105. Finally, a one-year zero-coupon bond of $105 and with a yield to maturity of 5.56%, calculates at a price of 105 / 1.0556^1 or 99.47. Coupon-bearing Bonds

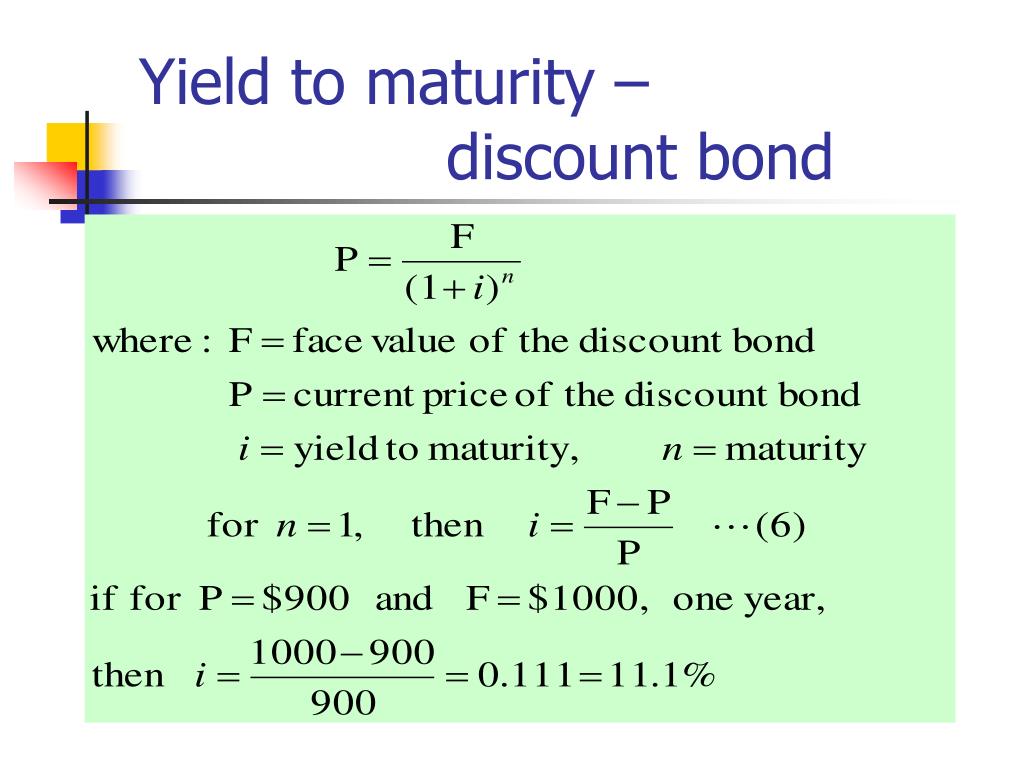

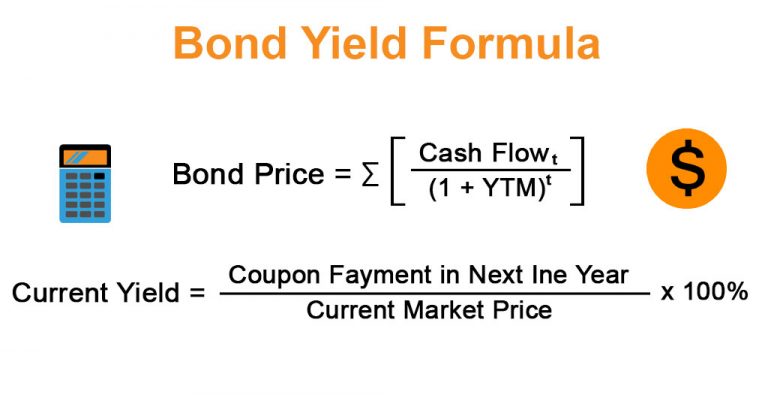

Yield to maturity - Wikipedia The yield to maturity (YTM), book yield or redemption yield of a bond or other fixed-interest security, such as gilts, is an estimate of the total rate of return anticipated to be earned by an investor who buys a bond at a given market price, holds it to maturity, and receives all interest payments and the capital redemption on schedule. It is the (theoretical) internal rate of return …

Yield to maturity coupon bond

Yield to Maturity - Approximate Formula (with Calculator) Example of Yield to Maturity Formula. The price of a bond is $920 with a face value of $1000 which is the face value of many bonds. Assume that the annual coupons are $100, which is a 10% coupon rate, and that there are 10 years remaining until maturity. This example using the approximate formula would be Yield to Maturity (YTM) Definition - Investopedia May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... Understanding Coupon Rate and Yield to Maturity of Bonds Security Name. Coupon Rate. Maturity Date. RTB 03-11. 2.375%. 3/9/2024. The Coupon Rate is the ...

Yield to maturity coupon bond. How to Calculate Yield to Maturity: 9 Steps (with Pictures) - wikiHow Once you have that information, plug it into the formula , where, P = the bond price, C = the coupon payment, i = the yield to maturity rate, M = the face value and n = the total number of coupon payments. [5] For example, suppose your purchased a $100 bond for $95.92 that pays a 5 percent interest rate every six months for 30 months. Calculate the YTM of a Coupon Bond - YouTube This video explains the meaning of the yield to maturity (YTM) of a coupon bond in the coupon bond valuation formula and how to calculate the YTM using a fin... Yield to Maturity (YTM) - Overview, Formula, and Importance Yield to Maturity (YTM) - otherwise referred to as redemption or book yield - is the speculative rate of return or interest rate of a fixed-rate security, such as a bond. The YTM is based on the belief or understanding that an investor purchases the security at the current market price and holds it until the security has matured (reached its full value), and that all interest and coupon payments are made in a timely fashion. Yield to Maturity Calculator | Calculate YTM In the yield to maturity calculator, you can choose from six different frequencies, from annually to daily. In our example, Bond A has a coupon rate of 5% and an annual frequency. This means that the bond will pay $1,000 * 5% = $50 as interest each year.

Yield to Maturity (YTM) - Meaning, Formula & Calculation - Scripbox Using the YTM formula, the required yield to maturity can be determined. 700 = 40/ (1+YTM)^1 + 40/ (1+YTM)^2 + 1000/ (1+YTM)^2 The Yield to Maturity (YTM) of the bond is 24.781% After one year, the YTM of the bond is 24.781% instead of 5.865%. Hence changing market conditions like inflation, interest rate changes, downgrades etc affect the YTM. Bond Yield to Maturity (YTM) Calculator - DQYDJ The Bond Yield to Maturity Calculator computes YTM using duration, coupon, and price. The approximate and exact yield to maturity formula are inside. ... Yield to Maturity of Zero Coupon Bonds. A zero coupon bond is a bond which doesn't pay periodic payments, instead having only a face value (value at maturity) and a present value (current ... dqydj.com › bond-yield-to-maturity-calculatorBond Yield to Maturity (YTM) Calculator - DQYDJ Estimated Yield to Maturity Formula. However, that doesn't mean we can't estimate and come close. The formula for the approximate yield to maturity on a bond is: ( (Annual Interest Payment) + ( (Face Value - Current Price) / (Years to Maturity) ) ) / ( ( Face Value + Current Price ) / 2 ) Let's solve that for the problem we pose by default in the calculator: Current Price: $920; Par Value: $1000; Years to Maturity: 10 Yield to Maturity (YTM) - Wall Street Prep From the perspective of a bond investor, the yield to maturity (YTM) is the anticipated total return received if the bond is held to its maturity date and all coupon payments are made on time and are then reinvested at the same interest rate. In This Article What are the steps to calculating the yield to maturity (YTM) in Excel?

› terms › yYield to Maturity (YTM) Definition - Investopedia May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... › ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ... Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ... Yield to Maturity | Formula, Examples, Conclusion, Calculator The approximate yield to maturity of this bond is 11.25%, which is above the annual coupon rate of 10% by 1.25%. You can then use this value as the rate (r) in the following formula: C = future cash flows/coupon payments r = discount rate (the yield to maturity) F = Face value of the bond n = number of coupon payments

Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond.. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value.For example, if a bond has a face value of $1,000 and a coupon rate of 5%, …

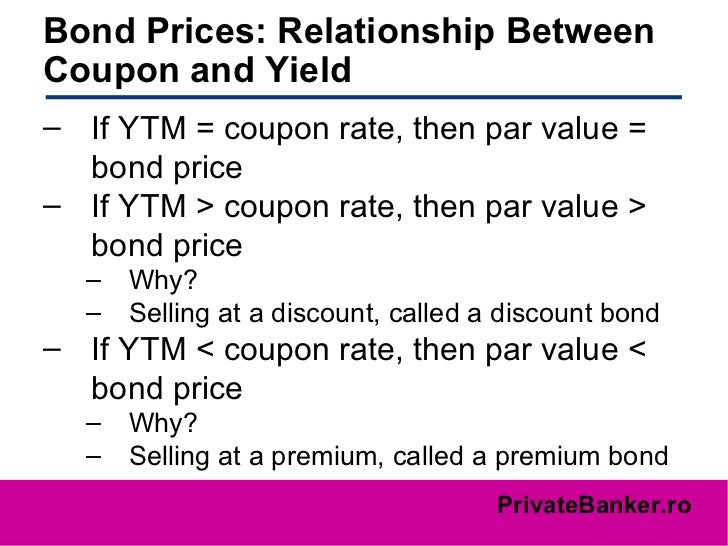

› bonds › 07Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · Bond Prices and Yields: An Overview . If you buy a bond at issuance, the bond price is the face value of the bond, and the yield will match the coupon rate of the bond.

Coupon Bond Formula | Examples with Excel Template - EDUCBA Coupon Bond = $25 * [1 – (1 + 4.5%/2)-16] + [$1000 / (1 + 4.5%/2) 16; Coupon Bond = $1,033; Therefore, the current market price of each coupon bond is $1,033, which means it is currently traded at a premium (current market price higher than par value). Explanation. The formula for coupon bond can be derived by using the following steps:

› ask › answersBond Yield Rate vs. Coupon Rate: What's the Difference? Mar 22, 2022 · If a bond's purchase price is equal to its par value, then the coupon rate, current yield, and yield to maturity are the same. When discussing bonds, it is important to note the many different ...

Basics Of Bonds - Maturity, Coupons And Yield - InCharge Debt Solutions As the price of a bond goes up, its yield goes down, and vice versa. If you buy a new bond at par and hold it to maturity, your current yield when the bond matures will be the same as the coupon yield. Yield-to-Maturity (YTM) is the rate of return you receive if you hold a bond to maturity and reinvest all the interest payments at the YTM rate. It is calculated by taking into account the total amount of interest you will receive over time, your purchase price (the amount of capital you ...

Yield to Maturity Calculator | Good Calculators r = 6.48%, The Yield to Maturity (YTM) is 6.48% You may also be interested in our free Tax-Equivalent Yield Calculator Rating: 4.2 /5 (210 votes)

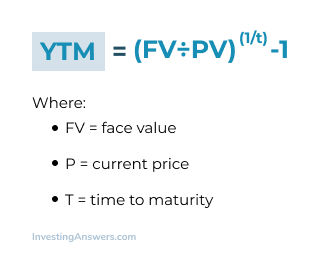

Yield to Maturity (YTM) - Definition, Formula, Calculations Yield to Maturity Formula = [C + (F-P)/n] / [ (F+P)/2] Where, C is the Coupon. F is the Face Value of the bond. P is the current market price. n will be the years to maturity. You are free to use this image on your website, templates, etc, Please provide us with an attribution link The formula below calculates the bond's present value.

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia Mar 22, 2022 · If a bond's purchase price is equal to its par value, then the coupon rate, current yield, and yield to maturity are the same. When discussing bonds, it is important to note the many different ...

Important Differences Between Coupon and Yield to Maturity - The Balance Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate.

Yield to Maturity (YTM) Definition & Example | InvestingAnswers Is Yield to Maturity the Same as Coupon Rate? The yield to maturity is the percentage of the rate of return for a fixed-rate security should an investor hold onto the asset until maturity. The coupon rate is simply the amount of interest an investor will receive. Also known as nominal yield or the yield from the bond, the coupon rate doesn't change.

Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · Bond Prices and Yields: An Overview . If you buy a bond at issuance, the bond price is the face value of the bond, and the yield will match the coupon rate of the bond.

EOF

How to Calculate Yield to Maturity: 9 Steps (with Pictures) - wikiHow May 06, 2021 · Yield to Maturity (YTM) for a bond is the total return, interest plus capital gain, obtained from a bond held to maturity. ... where, P = the bond price, C = the coupon payment, i = the yield to maturity rate, M = the face value and n = the total number of coupon payments. If you plug the 11.25 percent YTM into the formula to solve for P, the ...

Understanding Coupon Rate and Yield to Maturity of Bonds Security Name. Coupon Rate. Maturity Date. RTB 03-11. 2.375%. 3/9/2024. The Coupon Rate is the ...

Yield to Maturity (YTM) Definition - Investopedia May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

Yield to Maturity - Approximate Formula (with Calculator) Example of Yield to Maturity Formula. The price of a bond is $920 with a face value of $1000 which is the face value of many bonds. Assume that the annual coupons are $100, which is a 10% coupon rate, and that there are 10 years remaining until maturity. This example using the approximate formula would be

:max_bytes(150000):strip_icc()/dotdash_Final_Par_Yield_Curve_Apr_2020-01-3d27bef7ca0c4320ae2a5699fb798f47.jpg)

Post a Comment for "44 yield to maturity coupon bond"