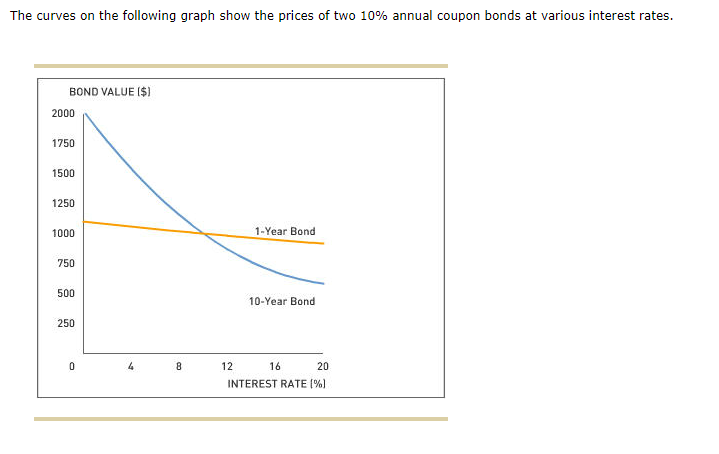

45 bond coupon interest rate

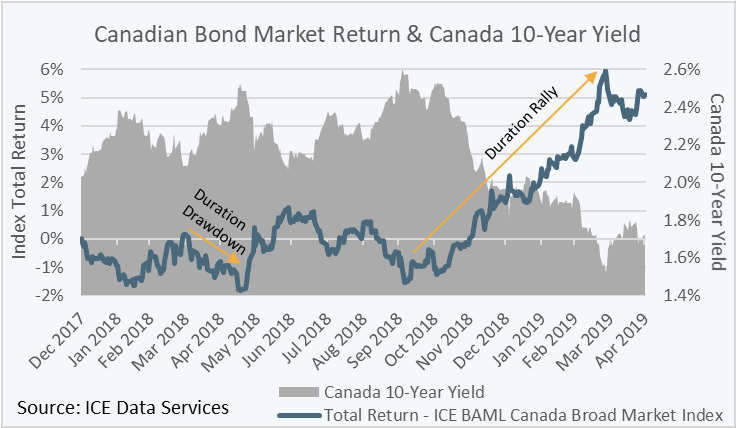

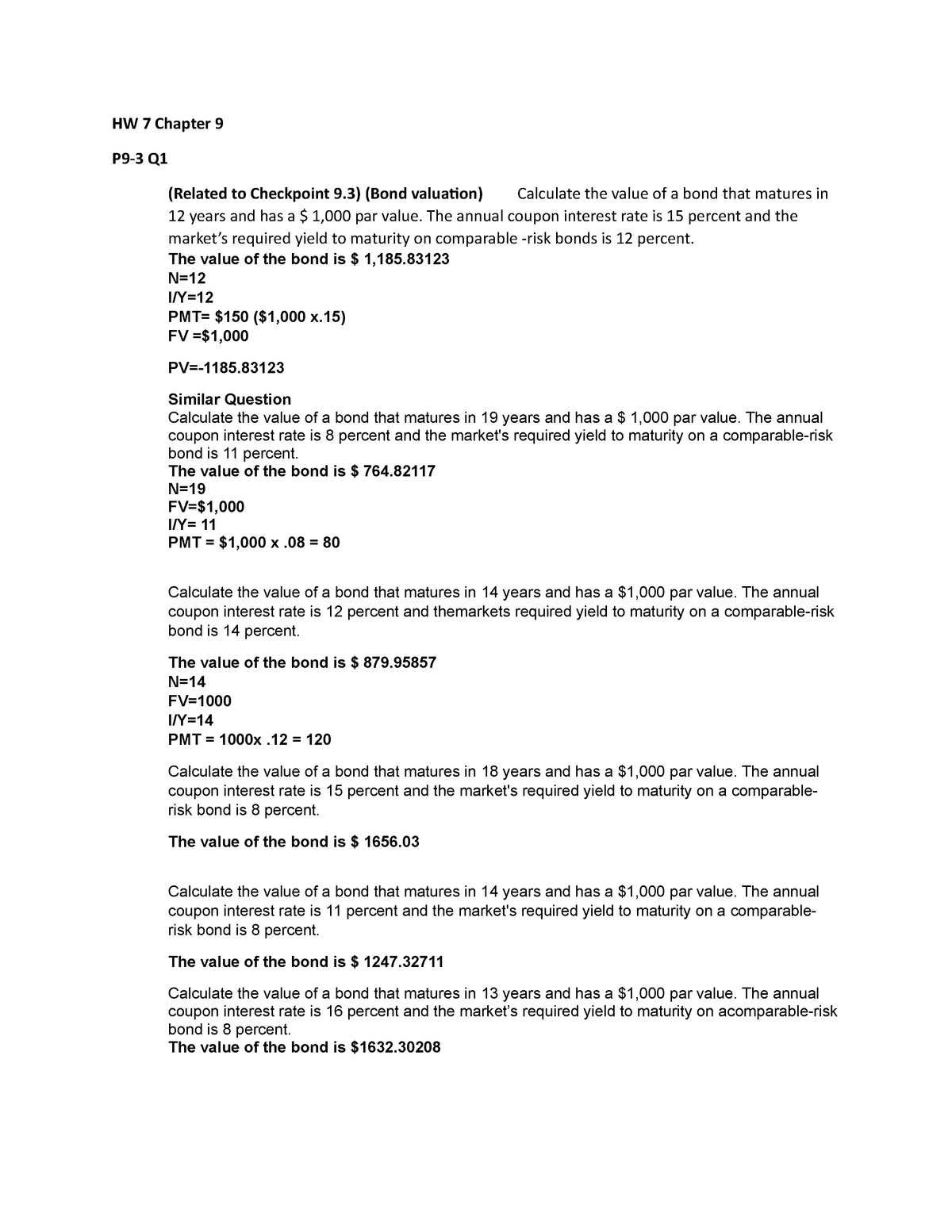

How to Calculate the Price of Coupon Bond? - WallStreetMojo The company plans to issue 5,000 such bonds, and each bond has a par value of $1,000 with a coupon rate of 7%, and it is to mature in 15 years. The effective yield to maturity is 9%. Determine the price of each bond and the money to be raised by XYZ Ltd through this bond issue. Below is given data for the calculation of the coupon bond of XYZ Ltd. Interest Rate Risk Definition and Impact on Bond Prices 25.9.2022 · Interest Rate Risk: The interest rate risk is the risk that an investment's value will change due to a change in the absolute level of interest rates, in the spread between two rates, in the shape ...

Bond Price Calculator – Present Value of Future Cashflows Using the Bond Price Calculator Inputs to the Bond Value Tool. Bond Face Value/Par Value - Par or face value is the amount a bondholder will get back when a bond matures.; Annual Coupon Rate - The annual coupon rate is the posted interest rate on the bond. In reverse, this is the amount the bond pays per year divided by the par value.

Bond coupon interest rate

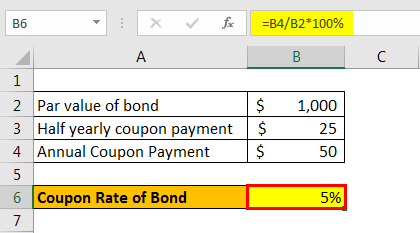

Coupon Rate: Formula and Bond Calculation - Wall Street Prep The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000 What Is a Coupon Rate? - Investment Firms Coupon rates can be determined by dividing the sum of the annual coupon payments by the actual bond's face value. However, this is not the same as the interest rate. For instance, a bond with a face value of $5,000 and a coupon of 10%, pays $500 every year. However, if you buy a bond above its face value, let's say at $7,000, you will get a ... Bond Price Calculator | Formula | Chart It can be calculated using the following formula: coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity.

Bond coupon interest rate. That Sky-High I Bond Interest Rate Will Be Coming Down to ... Oct 12, 2022 · Inflation-adjusted Series I savings bonds have been the most enticing place to park your cash this year—nearly 10% interest, backed by the U.S. government, the safest investment around.In a few ... Difference Between Coupon Rate and Interest Rate Coupon Rate vs Interest Rate Coupon Rate and Interest Rate are two financial terms used by investors, particularly in purchasing and managing investments. ... Coupon rate of a bond can simply be calculated by dividing the sum of coupon payments by the face value of a bond. As an example, if the face value of a bond is $100 and the issuer pays ... What is 'Coupon Rate' - The Economic Times Every year, you'll get Rs 100 (10 per cent of Rs 1,000), which boils down to an effective rate of interest of 10 per cent. However, if you bought the bond above its face value, say at Rs 2,000, you will still get a coupon of 10 per cent on the face value of Rs 1,000. It means you'll still get Rs 100. Understanding Pricing and Interest Rates — TreasuryDirect During the life of the bond or note, you earn interest at the set rate on the par value of the bond or note. The interest rate set at auction will never be less than 0.125%. ... Now, multiply your inflation-adjusted principal by half the stated interest (coupon) rate on your security. The resulting number is your semi-annual interest payment.

Bond Prices, Rates, and Yields - Fidelity Coupon rate—The higher a bond or CD's coupon rate, or interest payment, the higher its yield. That's because each year the bond or CD will pay a higher percentage of its face value as interest. Price—The higher a bond or CD's price, the lower its yield. That's because an investor buying the bond or CD has to pay more for the same return. Bond: Financial Meaning With Examples and How They Are Priced Jul 01, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ... What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities. What Is a Bond Coupon, and How Is It Calculated? - Investopedia If the bond later trades for $900, the current yield rises to 7.8% ($70 ÷ $900). The coupon rate, however, does not change, since it is a function of the annual payments and the face value,...

Difference Between Coupon Rate and Interest Rate The coupon rate is normally used in the bonds, which is an income to the holder after paying the rate on certain purchased items. Interest rate is a reduction to the borrower by paying back the amount he/she has borrowed. The coupon Rate ends according to the maturity period mentioned by the bondholder while issuing the bond. Basics Of Bonds - Maturity, Coupons And Yield - InCharge Debt Solutions Bond Coupon Payments. A bond's coupon is the annual interest rate paid on the issuer's borrowed money, generally paid out semi-annually on individual bonds. The coupon is always tied to a bond's face or par value and is quoted as a percentage of par. Say you invest $5,000 in a six-year bond paying a coupon rate of five percent per year ... When is a bond's coupon rate and yield to maturity the same? 13.1.2022 · A bond with a $1,000 par value and coupon rate of 5% pays $50 in interest each year until maturity. Suppose you purchase an IBM Corp . bond with a $1,000 face value, and it is issued with semi ... How to Calculate an Interest Payment on a Bond: 8 Steps - wikiHow For example, if long term interest rates rise from 5% (the coupon rate also) when the bond was purchased, the market price of a $1000 bond will fall to $500. Since the bond's coupon is only $50, the market price must fall to $500 when the interest rate is 10% to be marketable.

I bonds interest rates — TreasuryDirect the interest on I bonds is a combination of a fixed rate a inflation rate Current Interest Rate Series I Savings Bonds 6.89% For savings bonds issued November 1, 2022 to April 30, 2023. Fixed rate You know the fixed rate of interest that you will get for your bond when you buy the bond. The fixed rate never changes.

What is coupon on bonds? - moneycontrol.com Nov 24, 12:11. Coupon rate on the bonds is nothing but the rate of interest paid by the issuers to the investors on the bond's face value. The coupon rate is the annualised interest amount. Coupon ...

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing For example, if the face value of a bond is $1,000 and its coupon rate is 2%, the interest income equals $20. Whether the economy improves, worsens, or remains the same, the interest income does not change. Assuming that the price of the bond increases to $1,500, then the yield-to-maturity changes from 2% to 1.33% ($20/$1,500= 1.33%).

Rising bond yields: what happens to bonds when interest rates ... Oct 11, 2022 · That fixed rate of bond interest is formally called a coupon rate. For example, a bond with a 4% coupon pays £4 per year on its principal of £100.2. The £100 principal is the amount loaned to the government in the first place, when the bond is issued. When the bond matures, whoever owns it at that point will get that £100 back.

Coupon Rate Formula | Step by Step Calculation (with Examples) Dave said that the coupon rate is 10.00% Harry said that the coupon rate is 10.53% Annual Coupon Payment Annual coupon payment = 4 * Quarterly coupon payment = 4 * $25 = $100 Therefore, the coupon rate of the bond can be calculated using the above formula as, Coupon Rate of the Bond will be - Therefore, Dave is correct.

Coupon Bond - Guide, Examples, How Coupon Bonds Work Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay $5 in annual interest to investors for every bond purchased. After four years, on the bond's maturity date, Apple will make its last coupon payment.

Bond Price Calculator The algorithm behind this bond price calculator is based on the formula explained in the following rows: Where: F = Face/par value. c = Coupon rate. n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate. t = No. of years until maturity.

Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo Also, the issuer’s creditworthiness drives the coupon rate of a bond, i.e., a company rated “B” or below by any of the top rating agencies is likely to offer a higher coupon rate than the prevailing market interest rate to counterbalance the additional credit risk Credit Risk Credit risk is the probability of a loss owing to the borrower's failure to repay the loan or meet debt obligations.

Bond Coupon Interest Rate: How It Affects Price - Investopedia Say that a $1,000 face value bond has a coupon interest rate of 5%. No matter what happens to the bond's price, the bondholder receives $50 that year from the issuer. However, if the...

What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

Why Do Bond Prices Go Down When Interest Rates Rise? 16.2.2022 · The bond has a 3% coupon (or interest payment) rate, which means that it pays you $30 per year. If you’re paid every six months, you’ll receive $15 in coupon payments. Suppose you want to sell your bond one year later, but the market interest rate has increased to 4%.

Coupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

Solved Which of the following is true? If a bond sells for | Chegg.com If a bond sells for more than face value, the market rate of interest was more than the coupon interest. The coupon rate determines the yearly interest expense on bonds. Debenture bonds are secured by specific assets of the company. Interest expense increases each period when a bond is issued at a premium. The current market price of the bond ...

Interest rate - Wikipedia For an interest-bearing security, coupon rate is the ratio of the annual coupon amount ... Yield to maturity is a bond's expected internal rate of return, assuming it will be held to maturity, ... Interest rate targets are a vital tool of monetary policy and are taken into account when dealing with variables like investment, ...

How To Find Coupon Rate Of A Bond On Financial Calculator The coupon rate is the interest that a bond pays per year, divided by the bond's face value. For example, if a bond has a face value of $1,000 and pays a coupon rate of 5%, then the bond will pay $50 in interest each year.

Interest Rate Statistics | U.S. Department of the Treasury NOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are …

Coupon Payment Calculator Variable coupon payment - The amount paid in each period varies because the coupon rate is linked to a reference rate of interest, such as LIBOR or Euribor. For example, a bond indenture can define coupon rate equal to LIBOR rate plus 0.20%. In that case, the coupon rate gets recalculated periodically.

Zero-Coupon Bond: Definition, How It Works, and How To Calculate 31.5.2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

What do we mean by coupon interest rate of the 5.What do we mean by Coupon interest rate of the bond?Single choice. (2.5/2.5 Points) Value of the bond at maturity date Face amount. Stated interest rate Par value of the bond Future value of the bond Correct answers: Stated interest rate6.The primary market refers to:Single choice. (2.5/2.5 Points) All transactions on the NYSE Transactions ...

What Is the Coupon Rate of a Bond? - The Balance ABC bond's coupon rate was 3%, based on a par value of $1,000 for the bond. This translates to $30 of interest paid each year. Let's say Investor 1 purchases the bond for $900 in the secondary market but still receives the same $30 in interest. This translates to a current yield of 3.33%.

Coupon Rate vs Interest Rate | Top 8 Best Differences (with Infographics) a coupon rate refers to the rate which is calculated on face value of the bond i.e., it is yield on the fixed income security that is largely impacted by the government set interest rates and it is usually decided by the issuer of the bonds whereas interest rate refers to the rate which is charged to borrower by lender, decided by the lender and …

Bond Price Calculator | Formula | Chart It can be calculated using the following formula: coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity.

What Is a Coupon Rate? - Investment Firms Coupon rates can be determined by dividing the sum of the annual coupon payments by the actual bond's face value. However, this is not the same as the interest rate. For instance, a bond with a face value of $5,000 and a coupon of 10%, pays $500 every year. However, if you buy a bond above its face value, let's say at $7,000, you will get a ...

Coupon Rate: Formula and Bond Calculation - Wall Street Prep The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000

.png)

Post a Comment for "45 bond coupon interest rate"